Why teach economics and personal finance in schools?

-

All training provided by Economics Arkansas is certified by the Arkansas Department of Education, i.e., standards-based and curriculum aligned.

-

We are profoundly grateful to our donors who believe in strengthening tomorrow's workforce by supporting economic, entrepreneurship, and personal finance education.

-

From mastering the stock market to starting a business from scratch. Do your students have what it takes?

-

Teachers and student teams in grades 4-12 are invited to participate in this exciting investment simulation program.

-

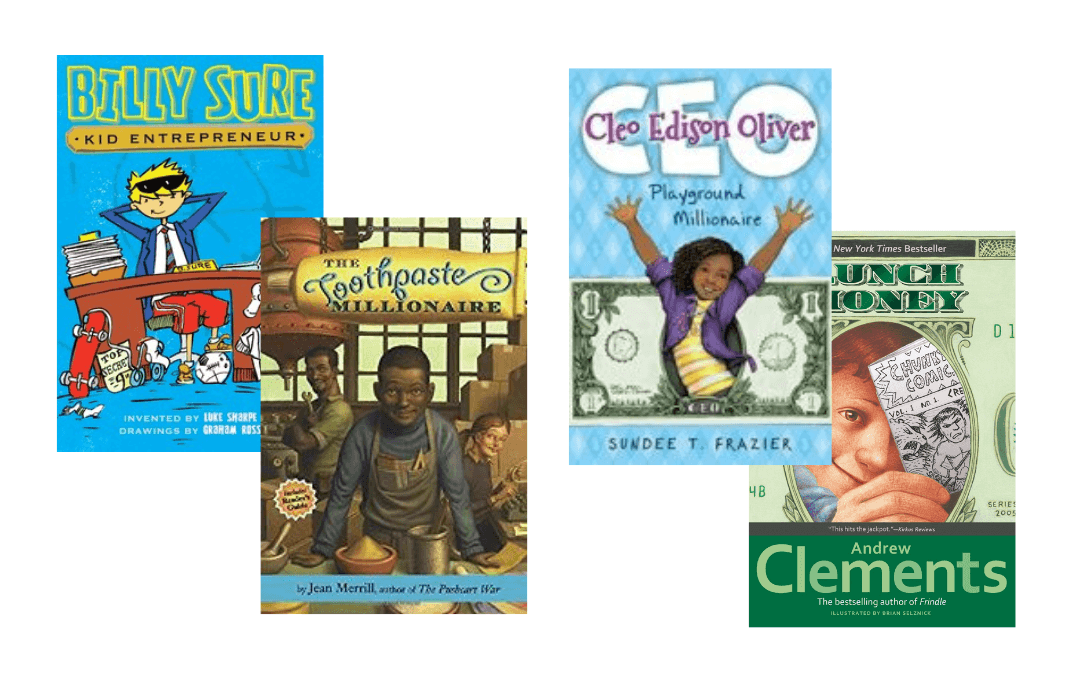

Lesson plans, student activities, and family reading guides to help students and their parents develop sound money management skills through children's literature.